As the cryptocurrency industry continues to evolve in an uncertain regulatory environment, several large banks are waiting for an opportunity to jump in.

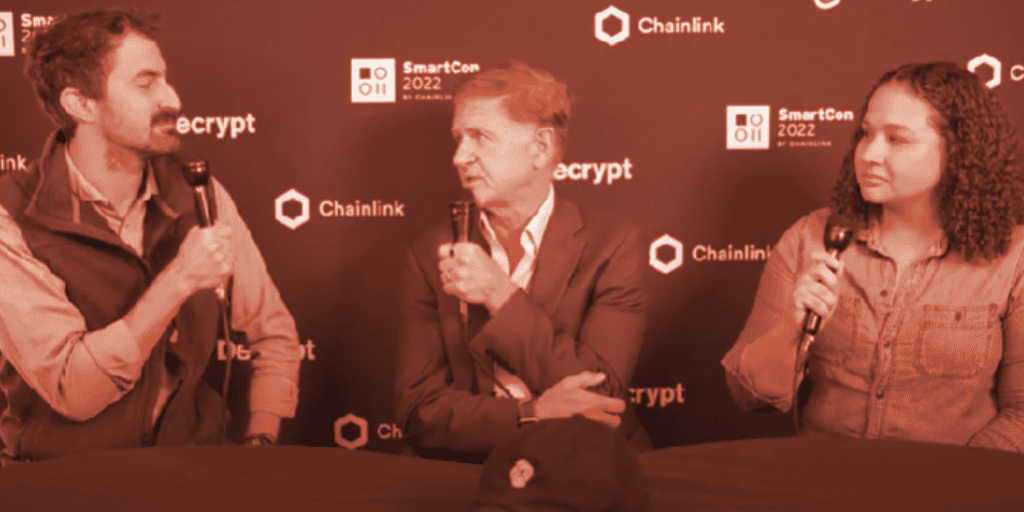

“There are more risk-averse firms in traditional finance coming into the [cryptocurrency] space,” Coin Metrics CEO Tim Rice told Decrypt at Chainlink SmartCon. “They care more about understanding how to mitigate their risks.”

Rice says that while firms that are already involved with cryptocurrency often get a pass when it comes to risk management, the people in new firms that are just dipping their toe into the space don’t have the same luxury.

“There are enough people in their firms who want crypto to fail,” Rice said. “Because of that, they’re being very buttoned up around examining the risks.”

As Rice explains, large banks in New York want in on the cryptocurrency market, but they want regulatory clarity first.

“Their main thing is, ‘We need regulatory clarity,’” he said. “Then we will come in, our clients want us in—so I think it’s just a matter of getting the right regulations in place that get them comfortable.”

“They just need it to get covered,” he said.

Founded in 2017, Coin Metrics is an open-source data analytics platform for public blockchains. Coin Metrics says its aim is “empowering people to make informed crypto financial decisions.” For Rice, that empowerment comes through the blockchain’s transparency.

“The super positive thing about crypto, with Celsius and Voyager and some of these other exposures. is the blockchain is this beautifully elegant solution to see what’s going on,” he said, noting that it took over five years to unpack why Lehman Brothers failed in 2008.

As Rice explains, Coin Metrics does not get involved directly with Washington D.C. and regulators. Still, the firm’s data and content have been used by others to justify proposed regulatory frameworks.

“They like our tooling and everything else,” Rice said. “But we’ve got kind of a core crypto-native quasi-anarchists view, and we are not de-anonymizing any of the actors within the crypto space.”

But while most banks are waiting for regulatory clarity, Rice says that very few are preparing or making their own way to jump into the space.

“There are those that are at the starting line in the sailboat race, ready to go when the wind comes in,” he said. “These [banks] are still on the shore trying to figure out how to paddle the skiff out to get to the boat.”