How Crypto Miners Are Diversifying Into AI, According to JP Morgan

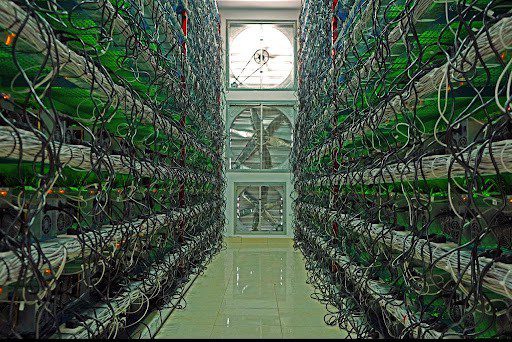

As crypto mining firms rapidly expand infrastructure ahead of the 2024 Bitcoin halving, the industry is also branching out into another growing tech frenzy: artificial intelligence.

A report from JP Morgan on Thursday explained how mining businesses are now repurposing their infrastructure to provide high-performance computing services.

Miners Pivot to AI

As led by Nikolaos Panigirtzoglou, the analysts wrote that miners are partly funding their shift to AI by selling BTC netted from their mining business.

One miner making the transition is Texas-based firm Applied Digital, which has signed a $460 million deal to host cloud computing in its data center. “As the AI industry continues to grow at unprecedented levels, we continue to see extraordinary demand for our new cloud service as a result,” wrote the company in a press release surrounding the deal in June.

British Columbia-based miner Iris Energy has also revived plans to host HPC services, given its access to cheap renewable energy and large data center capacity. “Recent discussions with market participants have further validated this previous work and that the time may be right to expand into this sector, utilizing Iris Energy’s four existing operating sites,” the firm said in June.

Yet it isn’t just Bitcoin miners: former Ethereum miners left stranded after the network’s merge upgrade in September may now have a new purpose in the sector.

“With the rapid growth of AI, the increased demand for HPC is now opening a new and perhaps more profitable avenue for utilizing GPUs previously used for Ethereum mining,” JP Morgan said.

More Profitable Than Mining?

The analysts claim that several miners have already conducted beta tests for offering HPC services using small portions of their computer fleet. At present, each machine appears to be far more profitable per unit of power consumption than it would otherwise be from mining BTC.

“If the profitability reported in beta tests is able to be repeated in a large scale it would overshadow in the future the revenues coming from bitcoin mining at the moment,” analysts added.

Miners aren’t only diversifying by industry, but by geography: analysts say the industry is moving into Russia, where there has been a massive energy surplus since the nation’s war with Ukraine began.

“Coupled with a colder climate, Russia is thus able to offer significantly cheaper energy resources to bitcoin miners,” they said.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.