Bitcoin Hashrate Jumps 92% in 2 Months, Difficulty Expected to Increase in 4 Days – Mining Bitcoin News

Bitcoin prices have improved a great deal in recent times and the network’s hashrate remains higher than it was 67 days ago when it tapped a low of 69 exahash on June 28. Today, statistics show Bitcoin’s hashrate has increased more than 92% since then and the network is due for another increased difficulty change in four days.

Bitcoin’s Hashrate Improves a Great Deal in 2 Months

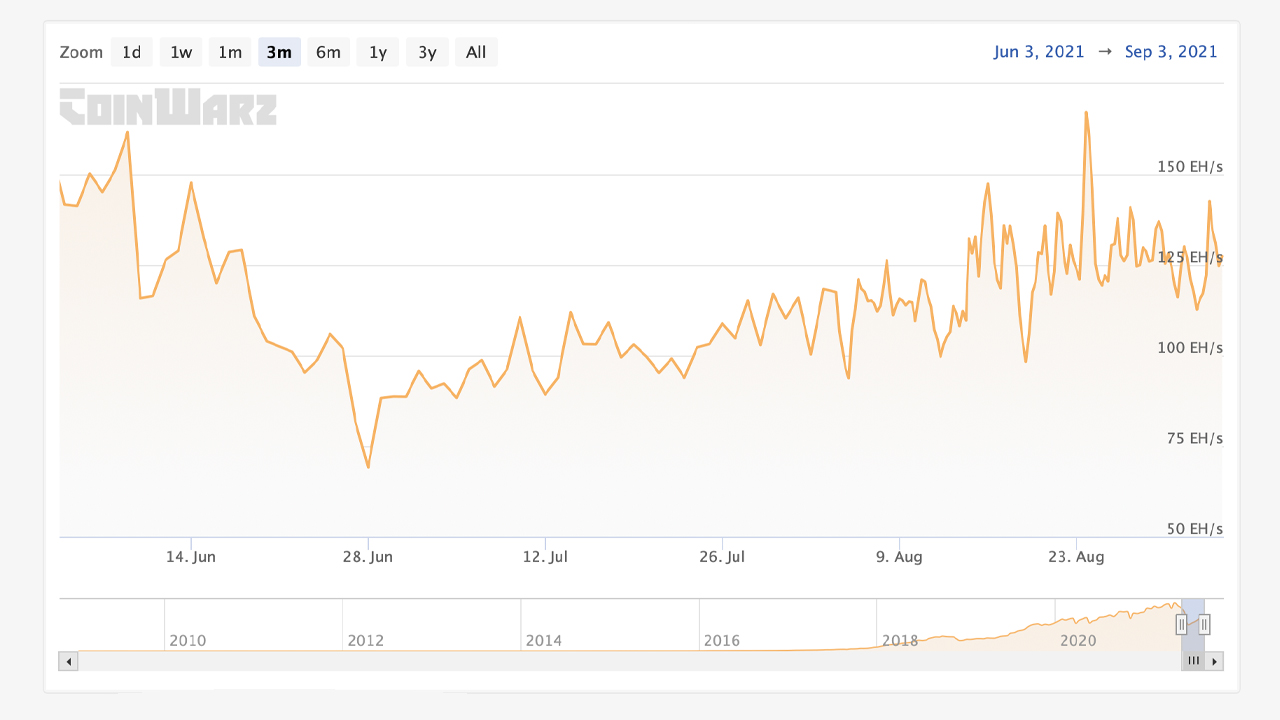

Bitcoin has risen more than 7% in fiat value during the last seven days and has a market capitalization of over $950 billion on Friday. At press time, three month hashrate stats from coinwarz.com shows BTC’s hashpower has increased a great deal since the end of June.

At that time, bitcoin miners from China were facing a crackdown from the government and were forced to relocate to other countries. BTC’s mining difficulty, however, started dropping well before the low drop to 69 exahash per second (EH/s). At the end of May, the difficulty slid by 15.97% and two weeks later another 5.3% decrease took place.

After the hashrate shuddered to 69 EH/s, the Bitcoin network saw the largest epoch mining difficulty decrease in the protocol’s lifetime. On July 3, 2021, the mining difficulty decreased by a whopping 27.94 % and two weeks later it dipped again down 4.81% on July 17.

After this time, during the course of the rest of July and throughout August, BTC’s price and hashrate saw a great recovery. The July 17, downward difficulty change was followed by the first increase in four consecutive downward shifts as it rose by 6.03% on July 29.

Upcoming Difficulty Change May Make it 28% Harder to Find a Bitcoin Block, Increase Will Erase July’s Largest Downward Difficulty Shift

Since then, the hashrate has been steady and BTC has seen a total of two increases since the 6.03% rise, and the very last increase jumped by 13.24%. Prior to that significant rise and following the 6% spike, the mining difficulty jumped 7.31% as well.

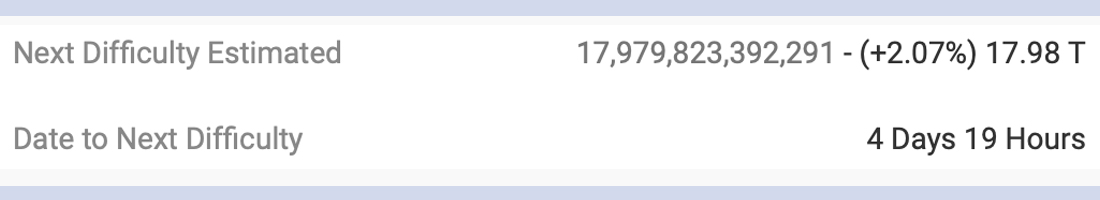

Today, coinwarz.com’s hashrate data shows the BTC network is coasting along at 133 exahash per second. At this current rate, in four days’ time, BTC’s mining difficulty is expected to rise from 17.62 trillion to 17.98 trillion. This would be a 2.07% increase at the time of writing, but depending on the hashrate it could increase or decrease from this point.

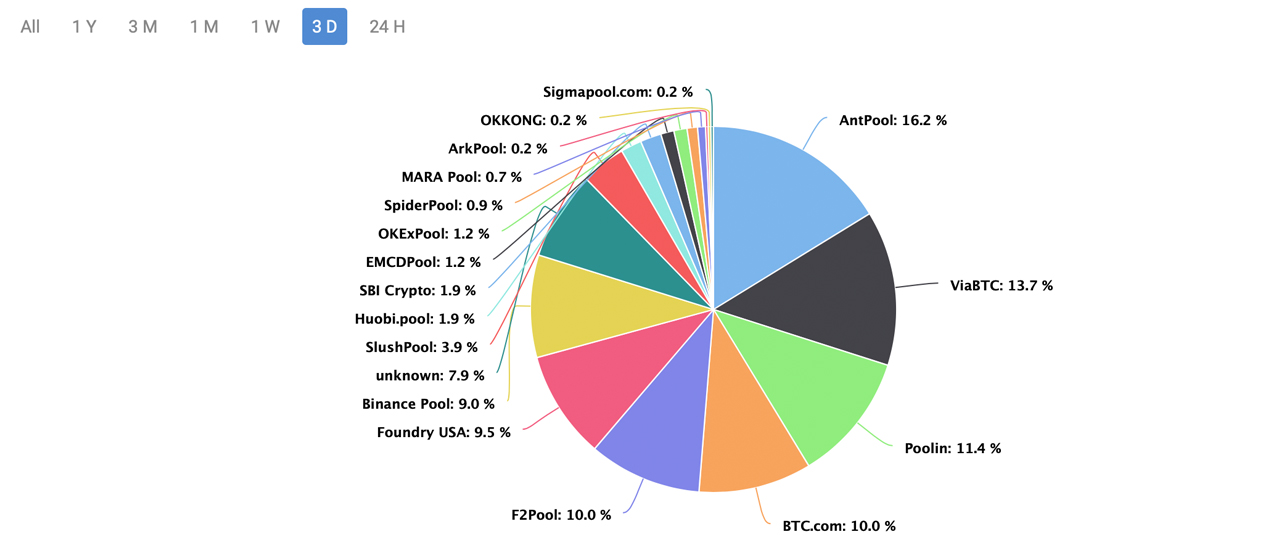

Today’s top mining pool in terms of BTC hashrate is Antpool with 16.24% of the network or 20.52 EH/s of hashrate. Viabtc follows Antpool with 13.69% of the network’s hashrate or 17.3 EH/s. Then there’s Poolin (11.37%), Btc.com (9.98%), F2pool (9.98%), Foundry USA (9.51%), Binance Pool (9.05%), and unknown hashrate (7.89%).

If estimates are correct and there’s a 2.07% difficulty increase in four days, it means since July 31, it’ll possibly be 28.65% more difficult to find a bitcoin (BTC) block in September 2021.

What do you think about the steady hashrate and the increased difficulty change slated for four days from now? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Btc.com, Coinwarz.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.