Bitcoin ETF in the US Will Probably Happen According to Novogratz

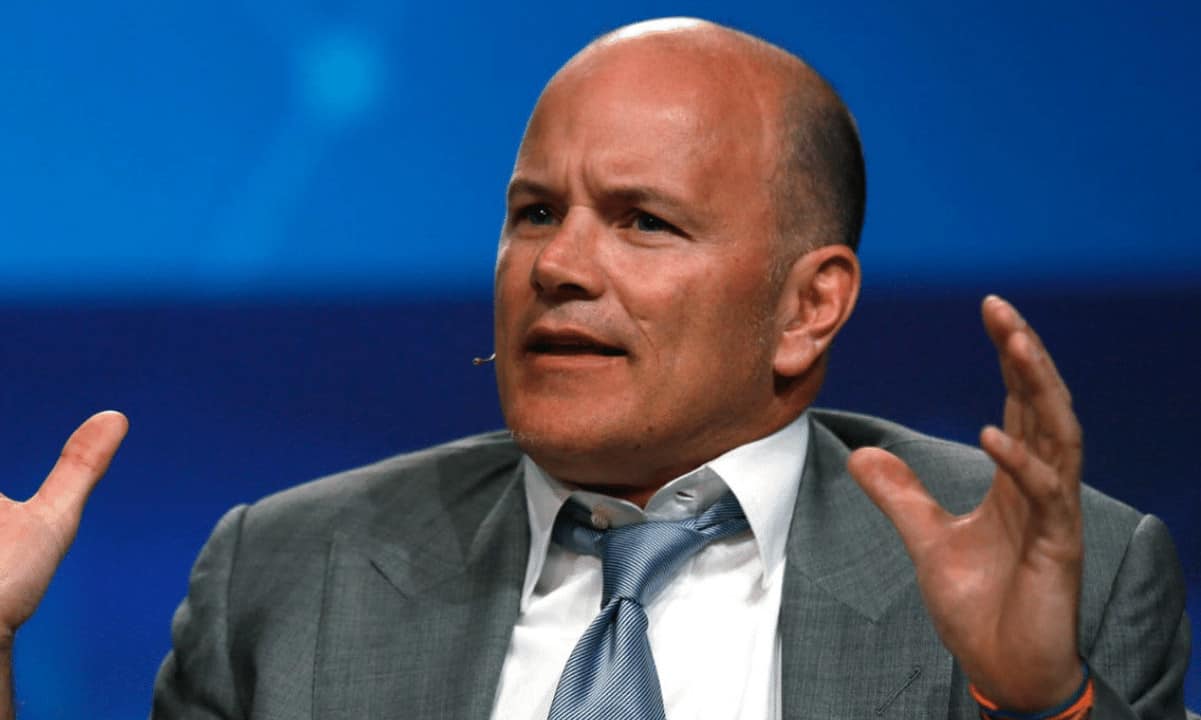

Mike Novogratz – a prominent bitcoin supporter and founder of Galaxy Digital – believes the US Securities and Exchange Commission (SEC) will likely approve the launch of a spot BTC ETF in America.

He also predicted that the price of the primary cryptocurrency will increase by the end of the year.

The ETFs Could Spark Broad Adoption of Bitcoin

In a recent interview for Bloomberg, the American billionaire said a possible green light on a spot BTC exchange-traded fund could be “the seal of approval” from the SEC and the US government that bitcoin is an asset.

He thinks that such a product offered by BlackRock and Invesco could fuel mass adoption by investors who were previously unable to join the ecosystem.

While Novogratz said his firm is also “in the process” of releasing that type of fund, he revealed, “it’s been a long and frustrating path.”

He also shared an optimistic prediction, suggesting BTC’s USD valuation will go up in the following months due to a potential pivot from the Federal Reserve:

“I think it ends the year higher.”

The central bank of the US adopted an aggressive interest rate hike strategy shortly after the COVID-19 pandemic shocked the world. The institution increased the benchmark ten times in a row between March 2022 and March 2023 before pausing the process last month.

Some experts suggested that the Fed will no longer lift interest rates once inflation in America starts cooling off. The latest US Consumer Price Index data showed some positive signs. The regular CPI was 3% YoY, 0.1% less than the estimations, whereas the Core CPI stopped at 4.8% YoY (lower than the expected 5%).

We are yet to see what the Federal Reserve’s move on that field will be. The next FOMC meeting is scheduled for July 26.

Approving the ETFs Would be ‘Hard to Resist

Another individual who believes a spot BTC ETF might see the light of day in the States is Jay Clayton – former Chairman of the US SEC.

The lawyer, who was quite skeptical about Bitcoin in the past, said he finds it “pretty remarkable” that finance behemoths like BlackRock, Fidelity Digital Assets, Valkyrie, Invesco, and others have filed to launch such a product.

Clayton thinks that if those companies prove that a spot BTC ETF will be sufficiently safe, the SEC will most likely say “yes:”

“If you can demonstrate that the spot market has similar efficacy to the futures market, it would be hard to resist approving a Bitcoin ETF.”

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.