Bitcoin Falls to $19k as Federal Reserve Announces 75 BPS Rate Hike

Following a two-day Federal Open Markets Committee (FOMC) meeting, the Federal Reserve has risen its benchmark interest rate by another 75 BPS.

Bitcoin’s price reacted erratically to the news, dropping by $1000 mere moments after the announcement.

The hike, revealed at 18:00 UST on Wednesday, takes the central bank’s new policy rate up between 3.0% to 3.5%.

Most investors expected a 75-point rise heading into the meeting, but markets had priced in a roughly 15% chance of a full percentage point rate increase.

Merely 1 minute after the announcement, Bitcoin fell from roughly $19,700 to $18,700. It’s since recovered to about $18,946, at the time of writing.

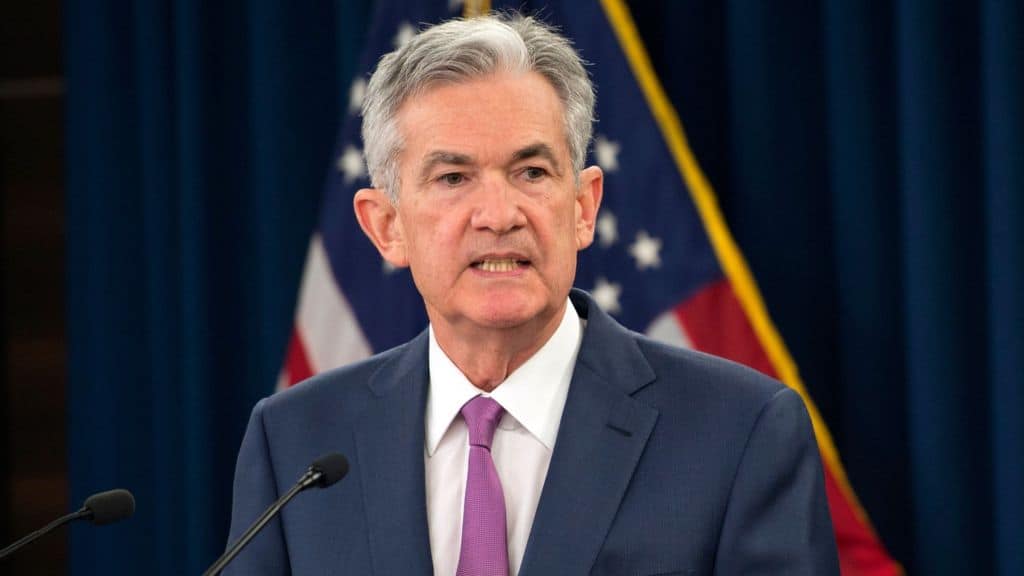

Volatility following a Federal Reserve decision is familiar territory for Bitcoin. The price fluctuated rapidly after Fed Chairman Jerome Powell’s speech at Jackson Hole last month, where he reiterated his commitment to addressing inflation.

Reducing inflation has been the theme of Fed policy for months, as inflation has marked historic highs throughout 2022. August CPI came in at 8.3% last week – higher than analysts were expecting.

Tightening monetary policy has caused both stocks and crypto to plummet throughout the year. Bitcoin is now 70% down from its November high of $69,000, while the NASDAQ is down 28% year to date.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.