Bitcoin Price Rises To $27,300 – How Will The Debt Ceiling Debate Influence BTC?

Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) price has displayed massive volatility since March, with United States macroeconomics lining up between then and May. However, as the releases streamed, the flagship crypto started showing directional bias, delivering a price action with evidence of bullish and bearish pressure.

The downtrend that started on the second week of the month caused Bitcoin price to plunge around 12% from a high of $29,820 on May 6 to a low of $25,811 on May 12. Nevertheless, a new uptrend series beginning May 14 could see BTC recover from the recent crashes, but a significant bullish catalyst is needed to fuel the rally.

Bitcoin Price Reaction To US Macroeconomic Woes With Special Focus on Debt Ceiling

Bitcoin (BTC) price dipped by almost 2.2% on May 4, bringing the total 2023 dips to a staggering 10%. The downtrend came despite BTC enjoying support from the recent CPI stats, which supported a positive shift in market sentiment. Nevertheless, fears about the US debt ceiling and the potential for a recession continue to weigh heavy on BTC and the broader cryptocurrency market.

Notwithstanding a recent Bloomberg report from the Markets Live Pulse survey has indicated that U.S. investors would rather trust their wealth in Bitcoin than the dollar if the U.S hits the debt ceiling.

As a result, Bitcoin maximalists are now worried about the current BRC-20 Meme Coin frenzy and its implication on transaction fees. Since the onset of Ordinals and the advent of the BRC-20 token standard in March, BTC-based meme coins have been on the rise. The meme coin frenzy captured the crypto market, as well, for a while, with Pepe (PEPE) and Milady (LADYS) tokens making headlines. As it took over Bitcoin too, issues began to arise.

BRC-20 – New trend of memecoins? 👀

Many people got rich because of the hype around memecoins on $ETH, but what to do if you didn’t buy $PEPE? It’s time for BRC-20, memecoins on Bitcoin!

Let’s find out more about it!

🧵 1/ pic.twitter.com/xqSoDh7PEt

— ElonMoney (@0xelonmoney) May 8, 2023

Bitcoin Investors Are Not Panic Selling Ahead Of The US Debt Ceiling

Still, despite the fidgety macroeconomic conditions, on-chain data shows no signs of a panic sell-off because long-term investors remain unyielding.

Among the key indicators of previous Bitcoin price dips is a panic-stricken sell-off by long-term investors. However, this does not seem to happen in the prevailing price correction. As shown in the chart below, BTC Mean Coin Age has remained sturdy on an uptrend this week, despite the heightened concerns around the US debt ceiling and money markets.

The Mean Coin Age metric assesses the average number of days every coin in circulation stays in its current or respective wallet addresses. A steady rise, as shown, is interpreted as investors holding their coins longer on average.

Since the May 6 hiccup that saw Bitcoin price drop below $29,000, BTC Mean Coin Age has continued to rise this week, ascending marginally from 1,465 to 1,472 days despite the 10% price retracement. This metric rising during a price correction suggests most long-term investors across the network are neither panic selling nor booking early profits- they are holding firm.

Although the recent pullback may result from short-term traders and speculators, the bullish resolve among long-term holders could set the tone for a positive Bitcoin price outlook.

Bitcoin Price Forecast With 10% Losses In Sight

Despite BTC investors holding steady, the overall outlook is still bearish, and Bitcoin price could crash further before a possible trend reversal. This points to investors’ belief in the king of crypto while they await a significant catalyst to fuel an uptrend.

At the time of writing, the Bitcoin price is $27,253, a daily rise of 1%, with volatility levels still high. While this indicates an effort by the bulls, the bears are still in control, possibly because of the cohort selling after breaking even from the rally and subsequent correction between March 11 and the April 21 dip.

While BTC has been trapped in a tight supplier congestion zone for nine days in a row starting May 8, an increase in seller momentum could set the tone for further declines, potentially flipping the $26,683 support level into resistance. Such a move would open the drains for the king crypto, likely initiating a drop down to the support confluence between the horizontal line and the 100-day Simple Moving Average (SMA) at $26,230.

In the dire case, Bitcoin price could tag the $25,000 support level, or worse, embrace the 200-day SMA around the $22,500 region.

This bearish outlook is supported by the Parabolic SAR, which flipped above the Bitcoin price during the first week of the month. Notably, this trend-following indicator tracking the price from above is often interpreted as a bearish sign.

The Relative Strength Index (RSI) also bolstered this negative outlook for Bitcoin price after rejecting the mean line during the New York trading session and calling a signal to “sell BTC” when it crossed below the signal line (yellow band). Traders heeding this call could solidify the downtrend.

Converse Case For Bitcoin Price

Conversely, a stronger wave of bullish momentum could see Bitcoin price shatter the $27,798 hurdle. A flip of this barricade into support could pave the way for further gains, with BTC potentially breaching the $28,970 resistance level before an extended neck up to the $30,441 level.

Bullish Investors Are Looking To Buy The Dip At $25,000, On-chain Metric Shows

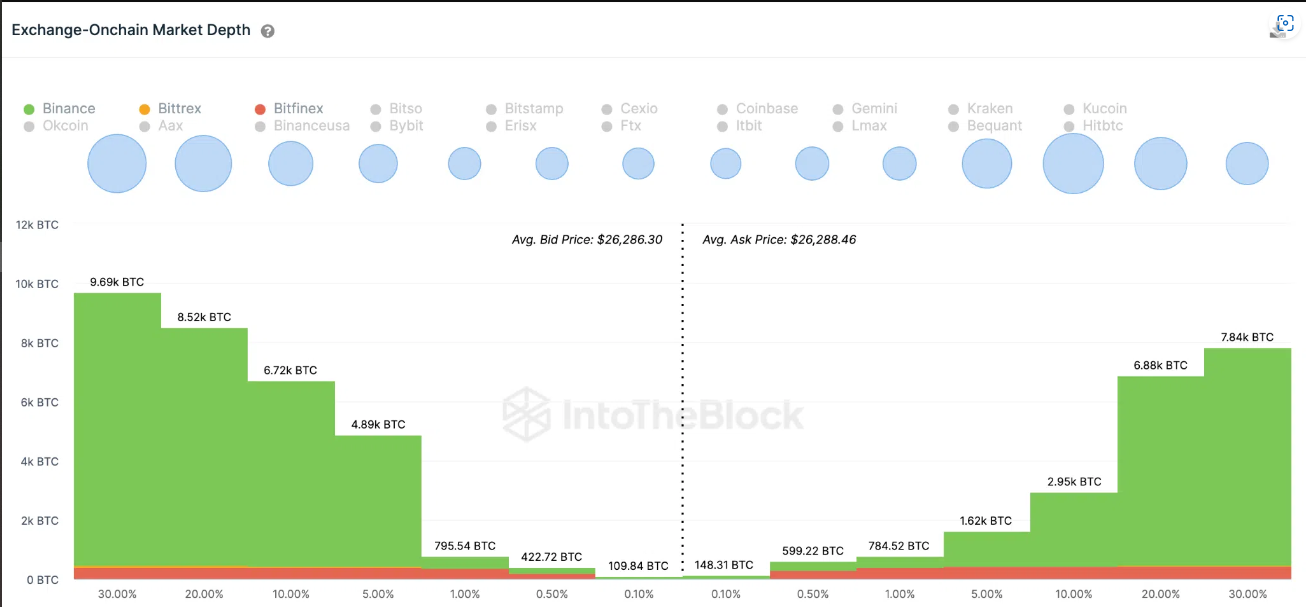

On-chain metric from IntoTheBlock’s Exchange Order Books shows that bullish investors plan to buy BTC at the low price of $25,000. According to this on-chain metric, the aggregate order books of exchanges presented above indicate that investors have placed active limit orders to buy 4,890 BTC around the $25,000 range. This is far higher than the 1,620 BTC sell-orders that traders have placed. Furthermore, the aggregate demand for the flagship crypto among exchanges exceeds the sell wall by over 10,300 coins.

With this excess demand and confidence among long-term holders, prices will likely rise quickly when the macro markets’ sentiment returns.

BTC Alternative

While Bitcoin price battles US macroeconomics, why not generate your own meme coins with the innovative AiDoge platform? This is touted as the greatest meme generation platform committed to revolutionizing the meme world.

Can anything stop the rise of $AI in the #Memecoin space? The answer is NO! 🤖🚀 #AiDoge is leading the charge, and nothing can stand in our way. 🔥

Don’t forget to join the #Presale before the next price increase! 🚀💪👉 https://t.co/5j5tt4smcs$PEPE $FLOKI $ELON $SPONGE pic.twitter.com/wUfGuri2aO

— aidogecrypto (@aidogecrypto) May 17, 2023

The platform leverages cutting-edge technology and a community-driven approach to generate the hottest memes. By offering an AI-driven meme generation experience, the platform makes it easy for users to adapt to the fast-paced cryptocurrency world.

The advanced AI technology ensures that all memes created are relevant based on the user’s text prompts. Among the most integral elements include:

AI-powered meme generator

Text-based prompts, and

$AI tokens for purchasing credits.

The meme generator’s innovative AI algorithms develop contextually relevant memes trained across a wide range of meme datasets and crypto news, ensuring quality abounds.

The AiDoge ecosystem is in the presale stage with its AI token. So far, the project has raised over $8.97 million USDT in presale sales, with barely three days to the next stage. Interested investors should buy AI now at current rates of $0.0000308 USDT before the next stage, where one AI token will retail for $0.0000312 and enjoy early entrant profits.

The #AiDoge presale is slipping away, and you don’t want to miss out! 😱

⏳ Time is running out to grab your bag of $AI tokens before the next price increase!📈🔥

Act fast and don’t let this opportunity slip through your paws! 🐾💪👉 https://t.co/5j5tt4smcs#MemeCoin #Web3 pic.twitter.com/Nxg4ht8qJB

— aidogecrypto (@aidogecrypto) May 18, 2023

Analysts are very optimistic about AiDoge, which makes now the ideal time to join the bandwagon before the train leaves the statin.

Visit AiDoge here

Read More:

AiDoge – New Meme to Earn Crypto

Earn Crypto For Internet Memes

First Presale Stage Open Now, CertiK Audited

Generate Memes with AI Text Prompts

Staking Rewards, Voting, Creator Benefits

Join Our Telegram channel to stay up to date on breaking news coverage