BlackRock holds $78 million in IBIT shares across two investment funds, new filings reveal

Key Takeaways

Two funds managed by BlackRock collectively hold $78 million worth of IBIT shares.

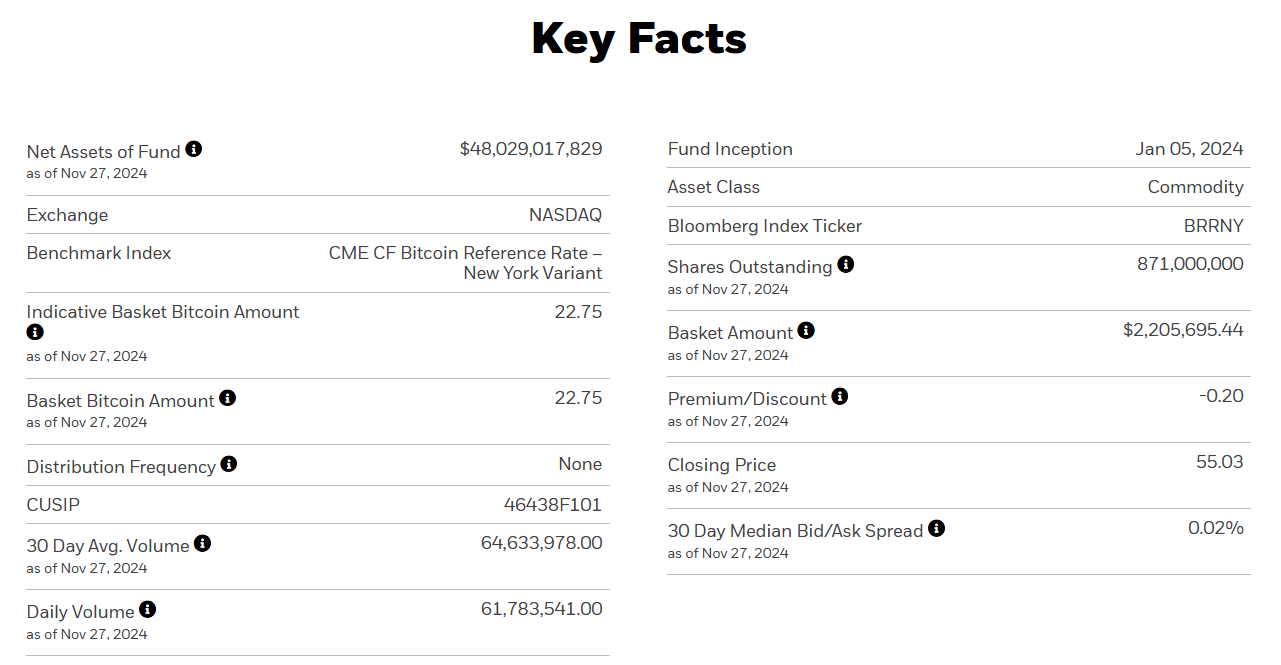

IBIT has grown to $48 billion in assets under management since January.

Share this article

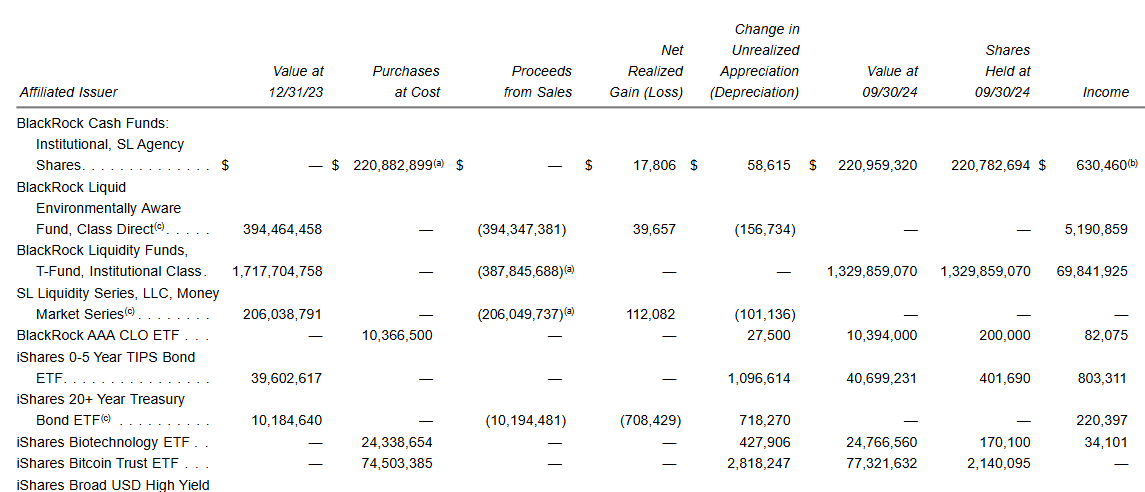

BlackRock has added more shares of the iShares Bitcoin Trust (IBIT) to two of its funds, totaling $78 million as of September 30, according to recent SEC filings first shared by MacroScope.

BlackRock Strategic Income Opportunities (BSIIX), managing $39 billion in assets, disclosed adding over 2 million shares of IBIT to its portfolio in the period ending September 30. It now holds around 2,1 million IBIT shares, valued at around $77 million.

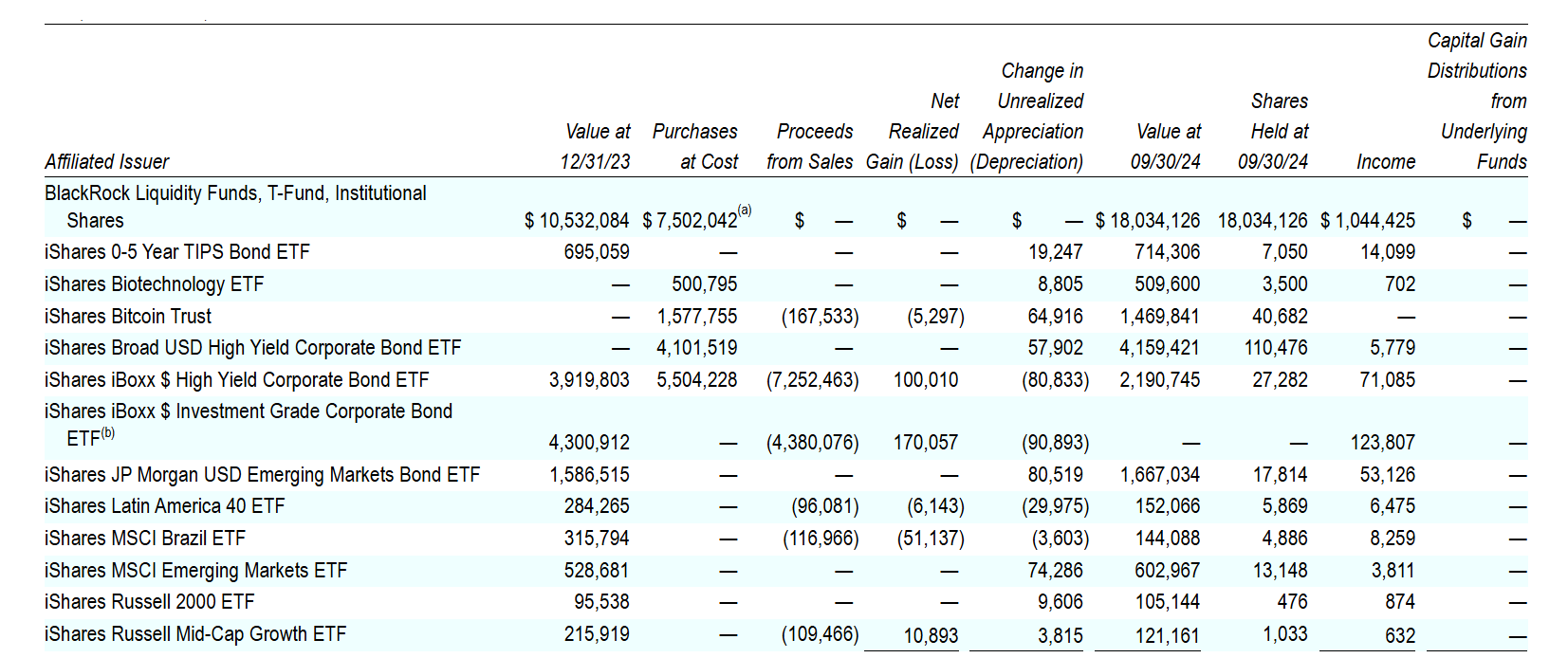

According to a separate filing, BlackRock Strategic Global Bond (MAWIX), overseeing $816 million worth of assets, bought over 24,000 shares of IBIT, increasing its total holdings to 40,682, worth around $1.4 million.

Both funds are managed by Rick Rieder, BlackRock’s chief investment officer (CIO) of global fixed income.

IBIT has seen rapid growth since it started trading in January, with roughly $48 billion in assets under management as of November 27. The fund has surpassed its gold-focused counterpart, the iShares Gold Trust (IAU), which holds approximately $33 billion.

IBIT has attracted investments from diverse groups of investors, including hedge funds, pension funds, and institutional investors.

In the latest 13F filings, Millennium Management topped the list with around $848 million in IBIT shares, followed by Goldman Sachs with $461 million and Capula Management with $308 million.

The Bitcoin ETF has maintained steady daily performance metrics, including trading volumes and capital flows, with over $30 million poured into the fund, according to data from Farside Investors.

Share this article