BTC Price Rises as Buyers Recoup above the $18.2K Low

Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin Bulls Buy the Dips as Buyers Recoup above the $18.2K Low – September 22, 2022

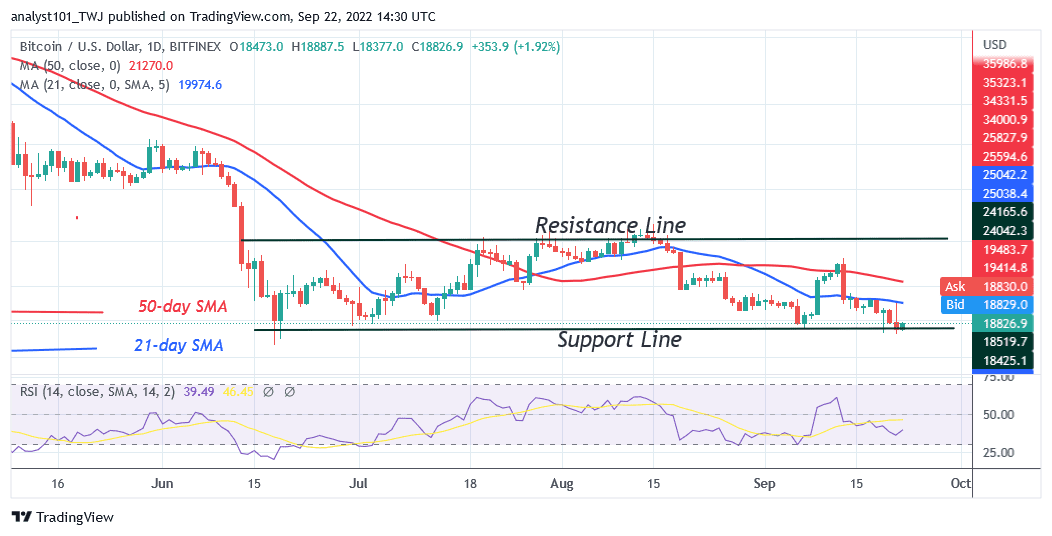

BTC/USD has regained bullish momentum as buyers recoup above the $18.2K Low. On September 19 upward correction, Bitcoin rallied to the high of $19,694 but could not break above the recent high. The largest cryptocurrency can recover above the $20,000 high if it breaks above the 21-day line SMA.

Bitcoin Price Statistics Data:•Bitcoin price now – $19,380.59•Bitcoin market cap – $371,292,517,229•Bitcoin circulating supply – 19,157,956.00 BTC•Bitcoin total supply – $408,467,922,046•Bitcoin Coinmarketcap ranking – # 1

Resistance Levels: $50,000, $55, 000, $60,000 Support Levels: $25,000, $20,000, $15,000

Buy Bitcoin Now

Your capital is at risk.

Bitcoin’s (BTC) price is in a downtrend but it is making an upward correction to retest and break above the 21-day line SMA. Yesterday, there was a price spike as Bitcoin rallied to the 21-day line SMA but dropped sharply above the current support. The current support at $18,200 has been retested by the bears twice as bulls bought the dips.

The current support may hold because of the task of two candlesticks with long tails. The long candlestick tails show strong buying at lower levels of price. Bitcoin has risen to the high of $19,380 as it approaches the 21-day line SMA. For instance, if buyers push the crypto above the 21-day line SMA, Bitcoin will rise to the 50-day line SMA. A break above the moving average lines will enable Bitcoin to reach the $25,205 overhead resistance.

BTC and ETH May Further Decline Ahead of Fed Interest Rate Hike – Bloomberg Analyst

The United States Federal Reserve’s inflation “sledgehammer” may further cause Bitcoin and Ethereum to decline. The latest Fed interest rate hike is likely to be announced this week. The expectation is that the market will have a minimum increase of a 75-basis-point. Others think that the interest rate hike could be as high as 100 basis points. According to Bloomberg analyst Mike McGlone, Fed’s actions will continue to dampen investor sentiment as Bitcoin and Ethereum decline to the bottom price level.

He said: “We have to turn over to the macro big picture and what’s been pressuring cryptos this year and that is the Fed sledgehammer.” During the interview, McGlone predicted that the latest rate hike could cause a crash across assets that are worse than the 2008 housing bubble meltdown: “I think it’s going to be worse than the 2008 correction, worse than the Great Financial Crisis.” The Fed started easing in 2007, and then they added massive liquidity. They cannot do that anymore,” he added.

Meanwhile, Bitcoin is making an upward correction as it reaches the high of $19,378. The upward movement will be accelerated if price breaks above the $20,000 high. Bitcoin is at level 44 of the Relative Strength Index for period 14. It indicates that Bitcoin is in the bearish trend zone despite the upward correction.

Related:• How to buy Tamagoge• Visit Tamadoge Website

Tamadoge – Play to Earn Meme Coin

Earn TAMA in Battles With Doge Pets

Capped Supply of 2 Bn, Token Burn

Presale Raised $19 Million in Two Months

Upcoming ICO on LBank, Uniswap

Join Our Telegram channel to stay up to date on breaking news coverage