BTC Price Struggles To Hold Above $19K

Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin Resumes Its Range Bound Move but Struggles to Hold Above $19K – October 10, 2022

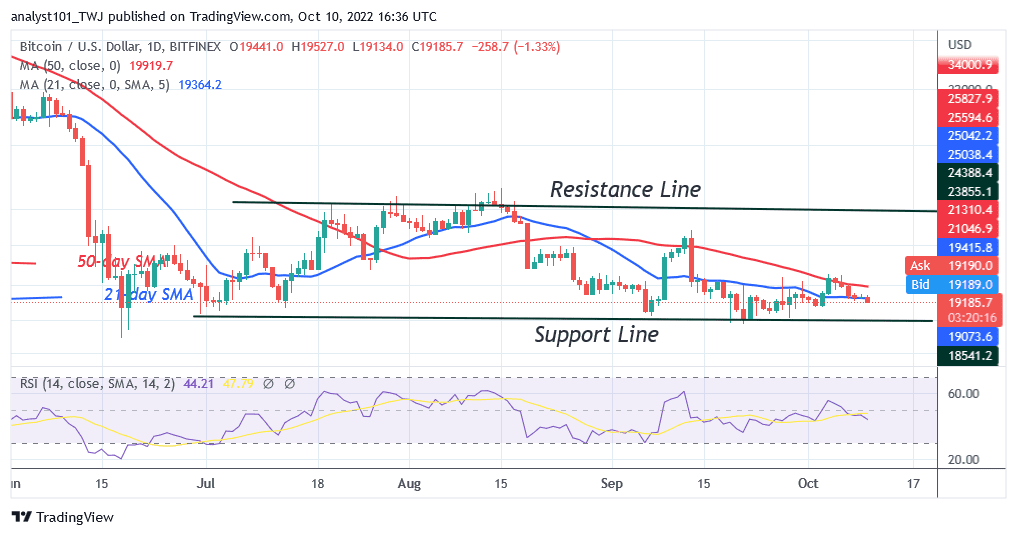

Since September 21 price slump, BTC/USD has been in a range-bound move but struggles to hold above $19K . On October 4, the bulls breached the resistance at $20,000. However, the breaking of the resistance was short-lived as it faced selling pressure at the high of $20,543.

Bitcoin Price Statistics Data:•Bitcoin price now – $19,099.19•Bitcoin market cap – $366,063,372,496•Bitcoin circulating supply – 19,175,943.00 BTC•Bitcoin total supply – $9,822,999,572•Bitcoin Coinmarketcap ranking – # 1

Resistance Levels: $50,000, $55, 000, $60,000 Support Levels: $25,000, $20,000, $15,000

Buy Bitcoin Now

Your capital is at risk

Bitcoin’s (BTC) price has resumed selling pressure after breaking below the moving average lines. The largest cryptocurrency asset may decline to the previous low at $18,200 as the price bars are below the moving average lines. On October 4, buyers have earlier broken above the moving average lines but failed to sustain the bullish momentum. Today, the BTC price has declined below the moving average lines as it reaches the low of $19,042. On the downside, the market will further decline to $18,200 if the $19,000 support is breached. On the other hand, Bitcoin will resume upward if the $19,000 support holds.

Investors Look beyond Bitcoin and Gold as Safe Haven Assets amid the Strengthening United States Dollar

Bitcoin and Gold are struggling to keep up with the inflation hedge narrative. According to report, the Safe Haven Assets are no longer investors’ primary choices as inflation hedges amid the strengthening United States dollar. Bitcoin has lost about 70% of its market cap since the market top last year. The financial markets have been hit by geopolitical tensions. Gold is currently down by 10% year-to-date . The position was strengthened in the first quarter of the year despite the Russia-Ukraine crisis. The correlation between Bitcoin and Gold has been fluctuating between -0.2 and +0.2 over the past years. However, the correction reached +0.3 for the past week. A correlation reading of +0.3 is slightly positive, while a value of +0.7 is regarded as a strong correlation.

Meanwhile, the BTC price is trading marginally but struggles to hold above $19K . The selling pressure has reached bearish exhaustion. The crypto is likely to resume an uptrend if the current support holds. Bitcoin has reached the oversold region as it is below the 20% range of the daily Stochastic.

Tamadoge – Play to Earn Meme Coin

Earn TAMA in Battles With Doge Pets

Maximum Supply of 2 Bn, Token Burn

Now Listed on OKX, Bitmart, LBank, MEXC, Uniswap

Ultra Rare NFTs on OpenSea

Join Our Telegram channel to stay up to date on breaking news coverage