BTC Risks Fresh Drop to $18,000 Support

The Bitcoin price prediction reveals that BTC is yet to gain strength above the moving averages as the coin shows a few bearish signs.

Bitcoin Prediction Statistics Data:

Bitcoin price now – $19,060

Bitcoin market cap – $366.5 billion

Bitcoin circulating supply – 19.0 million

Bitcoin total supply – 19.0 million

Bitcoin Coinmarketcap ranking – #1

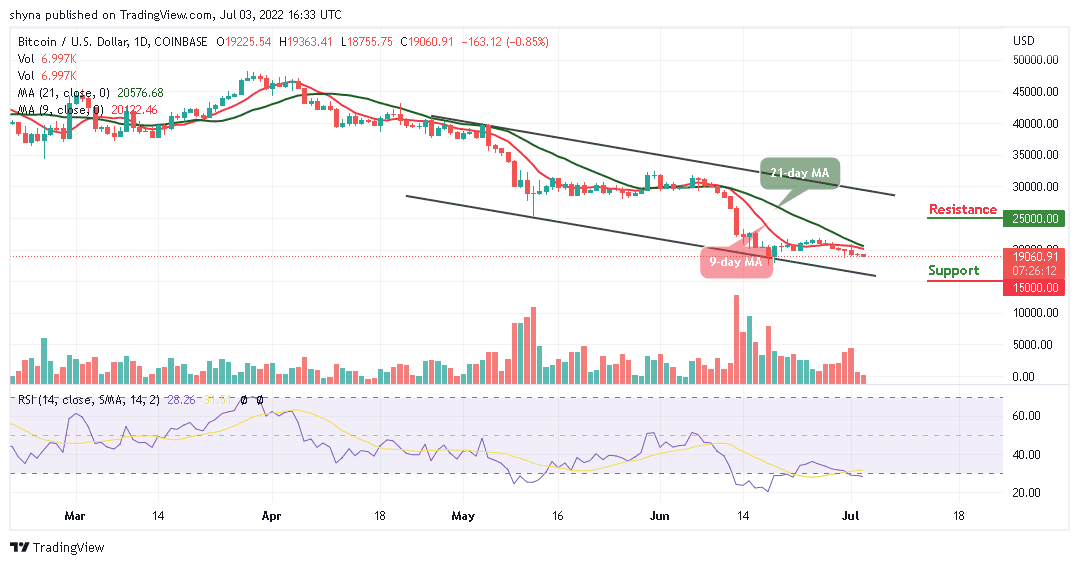

BTC/USD Long-term Trend: Bearish (Daily Chart)

Key levels:

Resistance Levels: $25,000, $27,000, $29,000

Support Levels: $15,000, $13,000, $11,000

After another failure to stay above the $19,000 level; BTC/USD remains below the 9-day and 21-day moving averages. The Bitcoin price could begin another decline if bulls failed to push it above the moving averages. At the opening of today’s trading; the touches the resistance level of $19,363, but any further bearish movement may keep the coin within the bearish zone.

Bitcoin Price Prediction: Would Bitcoin (BTC) Head to Downside?

As the Bitcoin price hovers below the moving averages, moving towards the lower boundary of the channel may begin to show bearish signs below the $19,000 and $18,000 levels. More so, if there are more losses, the price could break the major supports at $15,000, $13,000, and $11,000. Meanwhile, the technical indicator Relative Strength Index (14) moves into the oversold region to increase the bearish movement.

On the other hand, if the king coin crosses above the 9-day and 21-day moving averages; it could begin a bullish movement. Moreover, the main resistance could be located around the $20,000 level and a clear break above this level may push the price towards the resistance levels of $25,000, $27,000, and $29,000.

BTC/USD Medium-Term Trend: Ranging (4H Chart)

According to the 4-hour chart, the coin may gain lost momentum if the coin break above the moving averages, but at the moment, the volatility still hovers, and the selling pressure exists, which could lead the coin to the downside. Meanwhile, the $17,500 and below may come into play if BTC breaks below the lower boundary of the channel.

However, if the buyers can reinforce and power the market, traders can expect a retest at a $20,000 resistance level, and breaking this level may further allow the bulls to reach the resistance level of $21,000 and above. The Relative Strength Index (14) is crossing above 40-level, which shows that more bullish signals may play out.

eToro – Our Recommended Bitcoin Platform

Regulated by the FCA, ASIC and CySEC

Buy Bitcoin with Bank transfer, Credit card, Neteller, Paypal, Skrill

Free Demo Account, Social Trading Community – 20 Million Users

Free Bitcoin Wallet – Unlosable Private Key

Copytrade Winning Bitcoin Traders – 83.7% Average Yearly Profit

68% of retail investor accounts lose money when trading CFDs with this provider.

Read more: