Between the U.S. Treasury Department sanctioning coin mixer Tornado Cash earlier this month, and the long-awaited Ethereum merge quickly approaching, blockchain technologists are increasingly concerned that government regulations could impact the fundamental operation of Ethereum and its post-merge proof-of-stake consensus mechanism.

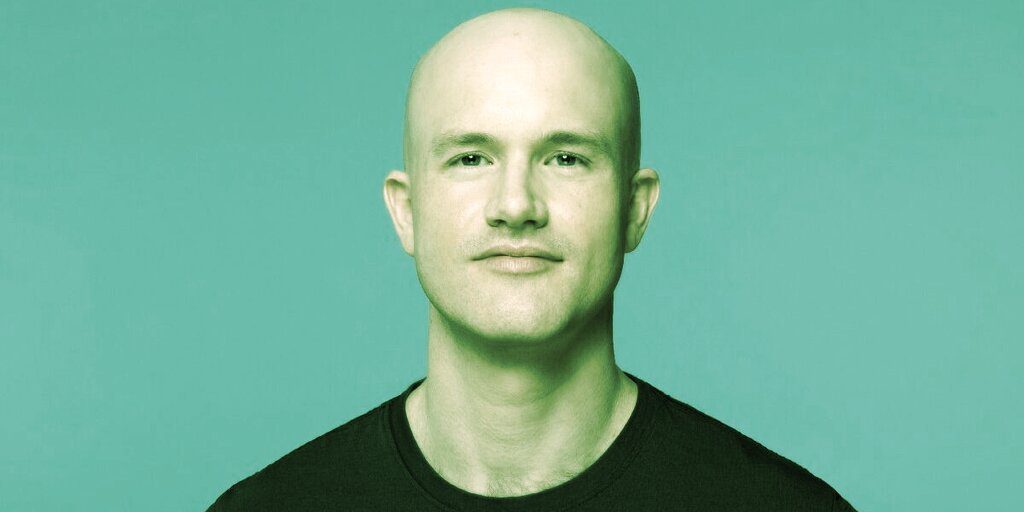

Coinbase CEO Brian Armstrong responded to a hypothetical scenario on Twitter today, saying that in the event of regulatory threats, his company would shut down its Ethereum staking service in order to preserve the integrity of the blockchain network.

The question was posed on Sunday by Lefteris Karapetsas, founder of open-source crypto analytics and accounting app Rotki. Karapetsas tagged several major Ethereum players, challenging them to choose between two options if government regulators demanded they censor specific addresses.

“Will you A) comply and censor at the protocol level [or] B) shut down the staking service and preserve network integrity,” he asked in a tweet, tagging Coinbase, Kraken, Lido, Staked, and Bitcoin Suisse. Armstrong, on behalf of Coinbase, is the only representative of one of the companies singled out in the scenario to respond, as of this writing.

“It’s a hypothetical we hopefully won’t actually face,” Armstrong replied. “But if we did we’d go with B I think. Got to focus on the bigger picture.”

He noted that a better, third option could present itself, or that a legal challenge “could help reach a better outcome.”

Armstrong’s answer is especially notable as Coinbase is betting much of its future on its lucrative staking service, calling it a “big win” for the company. And just this week, JPMorgan analysts said in a note that the Ethereum merge should be bullish for Coinbase and its shares (COIN) thanks to its Ethereum staking service.

“In early August, we began offering Ethereum staking for institutional clients for the first time,” Coinbase told shareholders a little over a week ago. ”We’ll continue to add more assets for staking for both our retail and institutional clients going forward.”

With the merge, Web3 investors and analysts are concerned large, institutional players that provide staking services for Ethereum are more likely to succumb to pressure from government regulators. And because they manage an outsized percentage of validators, their absence could threaten the entire network.

Eylon Aviv of blockchain and crypto investment firm Collider VC estimates that these large players would fall in line should U.S. regulators demand that they censor transactions, meaning as much as 66% of the Beacon Chain validators would essentially support censorship.

“There is a case to be made here that the Ethereum ecosystem has not reached sufficient social decentralization, and we are charting in very dangerous, nation state capture territory,” he wrote.

Last week, when news of the Tornado Cash ban broke, Armstrong tweeted, “Sanctioning a technology (as opposed to an individual or entity) seems like a bad precedent to me, and it should probably be challenged. Could have many downstream unintended consequences.”

“Hopefully obvious point: we will always follow the law,” he added.

At the time, Armstrong pointed to a February 4 Coinbase blog post he wrote to articulate the company’s “philosophy on account removal and content moderation.”

“Decentralization is the ultimate customer protection,” he wrote. “The decentralized nature of cryptocurrency offers its own important protections here, and those protections get stronger the more our products decentralize.”

Without the protection of a decentralized system, Armstrong says the Coinbase moderation policy could be “co-opted over time, succumb to pressure, or descend into us playing judge and jury.”

Stay on top of crypto news, get daily updates in your inbox.