We do the research, you get the alpha!

Get exclusive reports and access to key insights on airdrops, NFTs, and more! Subscribe now to Alpha Reports and up your game!

Go to Alpha Reports

Bitcoin, the world’s most prominent cryptocurrency, has garnered significant attention due to its extreme price volatility, presenting both substantial risks and potential rewards for investors. But two things are certain in the world of crypto: Halvings are bullish, and crypto winters follow halvings.

To better understand these terms, in the Bitcoin ecosystem the “halving,” is a pre-programmed occurrence that reduces the rate at which new bitcoins are created or mined by half. This event has historically been viewed as bullish for long-term holders, with 3,230% gains within one year after each halving according to Coingecko (yay). But shortly after this spike, Bitcoin’s price usually experience a significant downward correction, plunging into what is often referred to as a crypto winter as its price drops by more than 80% on average (ouch).

The Bitcoin network undergoes this halving event—a mechanism to control its inflation rate and maintain its scarcity over time—approximately every four years. The most recent halving occurred on May 11, 2020, reducing the block reward for Bitcoin miners from 12.5 to 6.25 BTC. This next halving will drop the mining reward to 3.123 BTC.

In general terms, the halving hype tends to last for about one year, followed by a major correction the year after. The first halving occurred on November 28, 2012, and by November 2013, Bitcoin experienced a significant decline, plummeting from $1,130 to $170 within the same year—a staggering 85% drop. The second halving in July 2016 exhibited a similar trajectory, with Bitcoin reaching $20,000 in November 2017 before crashing to $3,191 in the following months—an 84% decline. Most recently, the third halving in May 2020 propelled Bitcoin to an all-time high of $68,789 in November 2021, but it subsequently plunged to $15,600 by June 2022—a 77% correction.

Why does Bitcoin crash after the halving?

Some events have affected Bitcoin’s price performance at a fundamental level, like the launching of Bitcoin futures contracts, China’s crackdown on the crypto industry, or even Tesla’s tweets about ditching Bitcoin. But unlike these one-off events, the Bitcoin halving is a regularly scheduled occurance.

One potential reason behind the post-halving crashes is profit-taking by investors who have held their positions for an extended period, often motivated by the “January Effect.”

Investors believe that stock prices tend to rise in the first month of the year due to increased buying activity after price drops in December. This is often attributed to tax-loss harvesting, where investors sell off losing stocks in December to offset capital gains tax obligations and then repurchase them in January, driving up demand and prices.

It is possible that investors consider rebalancing their portfolios by selling risky assets like Bitcoin in December and reinvesting in stocks in January, which is traditionally a bullish month for equities.

Another significant factor is the “mining capitulation” phenomenon.

During their profitable season, miners accumulate Bitcoin and increase the network’s hashrate. However, a point comes when miners need to sell their holdings to upgrade or purchase more equipment and remain competitive or more profitable as the network grows stronger. Although not necessarily coinciding with price performance, this selling pressure—coupled with other bearish market sentiments—can trigger a snowball effect that can lead to mining capitulation and a subsequent price crash. When this occurs, miners sell their reserves and equipment not to remain competitive, but to remain operational.

According to data from Bitinfocharts, the Bitcoin hashrate dropped during the last two halvings.

Despite these cyclical corrections, Bitcoin has consistently demonstrated its resilience and ability to recover from significant drawdowns.

How do Bitcoin traders cope?

As MicroStrategy founder and chairman Michael Saylor, probably the most prominent Bitcoiner in all of Wall Street, stated in an interview with Emily Chang on Bloomberg’s Studio 1.0 in 2022, “If you’re going to invest in Bitcoin, a short time horizon is four years, a [medium] time horizon is ten years. The right time horizon is forever.” Saylor maintains that Bitcoin is a good investment for those willing to hold for at least one halving to the next.

“If you look over the course of four years, no one has ever lost money holding Bitcoin for four years,” he said.

Similarly, Bitcoin’s ultra-bullish periods followed by major crashes and subsequent bullish periods suggest that it is not a speculative bubble. Rather, it’s a volatile asset class gradually finding mainstream acceptance. In other words, these major corrections are relatively healthy for Bitcoin as they balance the mood among investors and avoid bubble-like scenarios that crash the prices to utter uselessness.

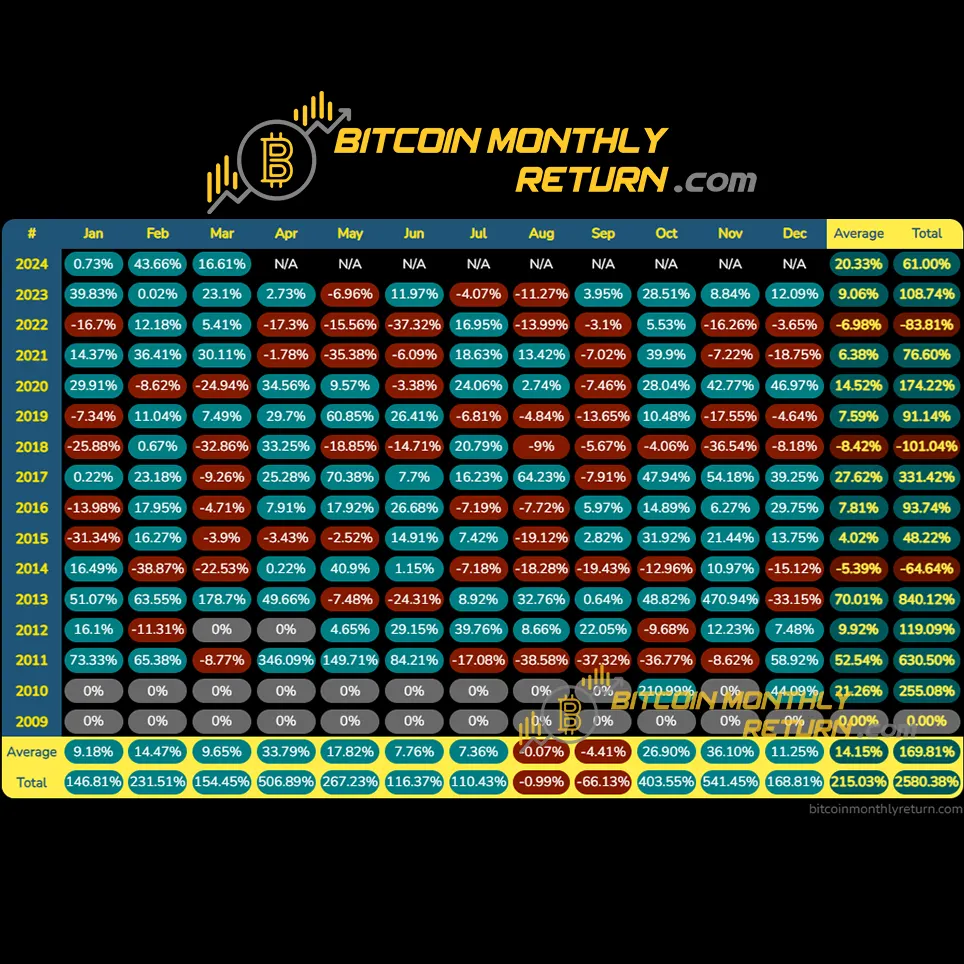

Now, it is known that the end of the year following each halving has historically marked the beginning of a crypto winter, but looking at a shorter time frame, September is a particularly bearish month for Bitcoin.

This poor performance in September coincides with similar downturns in the stock market, with the S&P 500 experiencing an average decline of 0.7% in September over the last 25 years—well before Bitcoin even existed. The “September effect” is attributed to investors exiting market positions after returning from summer vacations to lock in gains or tax losses ahead of the year’s end.

So, for what it’s worth, investors may want to avoid buying BTC in September or around Christmas the same year as a halving.

As the fourth Bitcoin halving approaches, with the price having recently reclaimed $71,000, investors and enthusiasts eagerly anticipate the potential implications. History suggests a post-halving correction may be on the horizon next year, but the circumstances today differ from any of the events that affected Bitcoin as an asset in the past. Regulations are clearer, Wall Street has poured billions of dollars into Bitcoin ETFs, countries have invested in the coin, and the network is stronger than ever.

Wall Street traders tend to say that time in the market beats timing the market. But for the Bitcoin community, HODL is a way of life. Deciding when to buy depends on you, but whatever decision you take, hurry up: The halving is just two weeks away.

Edited by Stacy Elliott.