No, Someone Didn’t Really Pay $532 Million for a CryptoPunk NFT

In brief

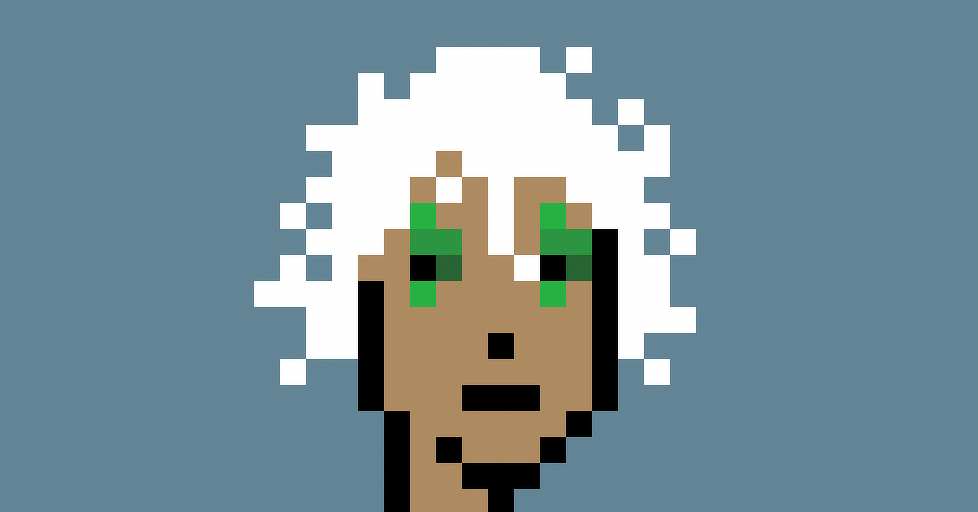

A CryptoPunks NFT apparently sold for $532 million worth of ETH tonight.

Larva Labs says it was due to someone playing around with flash loans, and isn’t technically a legitimate sale.

CryptoPunks are the ultimate blue chip of NFT avatar collections, with dozens of seven-figure USD sales and more than $1.5 billion of trading volume to date. Even so, a half-billion dollar sale is sure to turn a lot of heads, as it did earlier this evening.

But while a transaction was made, it wasn’t a legitimate sale. CryptoPunk #9998 triggered a sale alert just before 8pm EST on Wednesday, with a transaction price of more than 124,457 ETH, or $532 million at the time of sale.

Given that the all-time CryptoPunk sale record was merely $11.8 million, and that the current single NFT record is just over $69 million for digital artwork from Beeple, red flags immediately popped up. Some suspected a brazen act of wash trading, potentially to hide ill-gotten crypto gains, albeit one that would be very visible on a public blockchain like Ethereum.

Upon closer inspection, however, the transaction looks to be the work of someone playing around with DeFi flash loans, or uncollateralized crypto loans. In other words, it wasn’t an exploit.

“In a nutshell, someone bought this punk from themself with borrowed money and repaid the loan in the same transaction,” CryptoPunks creator Larva Labs tweeted. “Some recent large bids were done the same way. The ether is offered and removed in a single transaction. So, while technically briefly valid, the bid can never be accepted.”

Larva Labs’ trading platform still lists the transaction for the sale, but also shows that the buyer’s wallet ultimately ended up transferring the NFT back to the seller’s wallet.

Robert Miller, a steward at research organization Flashbots, tweeted a more detailed description of events. As he writes, the first contract put the CryptoPunk up for sale, and then a second contract borrowed an enormous amount of money via a flash loan and bought it. At that point, the first contract sent the money back to the second one, and then the loan was repaid.

Why, exactly? It appears that someone was shifting a bunch of cryptocurrency around for the hell of it—and a comparatively tiny transaction fee of about $800.

In fact, a closer look at Etherscan reveals a note in the transaction’s input data box when you view it with the UTF-8 display option. It reads: “‘looks rare’ – blurr n’ arr00.”

Larva Labs tweeted that it will add filters to transaction notifications so that such flash loan-fueled, non-valid transactions will no longer be shared out to the world. And CryptoSlam, a popular NFT analytics platform, said that it will delete the sale from its data set.

In other words, it’s almost like the $532 million CryptoPunk sale never happened. But it sure got people talking, didn’t it?