Tron (TRX) Defies Market Bears, Open Interest Jumps by 15%

In this current bearish market sentiment, Tron (TRX) appears bullish and is poised for a significant rally in the coming days. On October 4, 2024, while major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) were struggling to gain momentum, TRX successfully confirmed its bullish breakout.

Tron (TRX) Technical Analysis and Upcoming Levels

According to expert technical analysis, TRX appears bullish as it has successfully retested the breakout level of an inverted head and shoulder price action pattern. In trading, whenever an asset breaks out of any price action pattern, it should retest the pattern’s breakout level for a successful rally, otherwise, it is considered a weak breakout.

With this recent retest, TRX has formed a strong bullish daily candle. Based on the historical price performance, if the asset closes its daily candle above the $0.1575 level, there is a strong possibility that TRX could soar significantly and potentially reach a new all-time high in the coming days.

TRX Bullish On-Chain Metrics

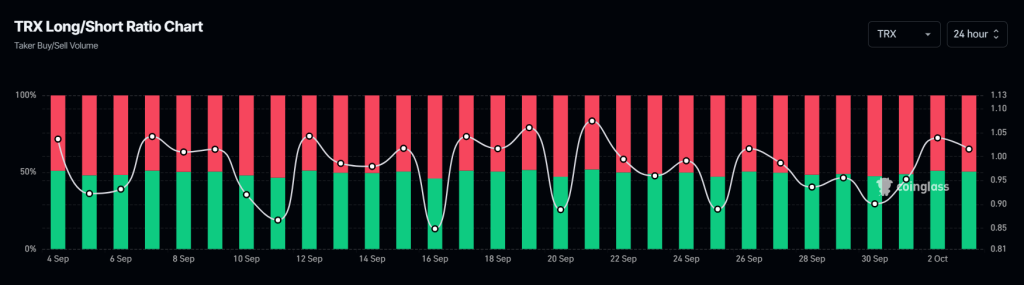

TRX’s positive outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, TRX’s Long/Short ratio currently stands at 1.034, indicating strong bullish sentiment among traders. Additionally, its future open interest has jumped by over 15% and continues to rise.

This increase in open interest, amid a bullish price action pattern, suggests that traders are potentially favoring long positions over short positions.

TRX Current Price Momentum

Currently, TRX is trading near $0.1572 and has experienced a price surge of over 2% in the past 24 hours. During the same period, its trading volume jumped by 13%, indicating higher participation from investors and traders likely due to its bullish outlook.

Whereas, major cryptocurrencies like BTC, ETH, and SOL have experienced a price decline of 3.5%, 4.1%, and 4.35%, respectively, according to the coinmarketcap data.